Oaktree's mission is to deliver superior investment results with risk under control and to conduct our business with the highest integrity.

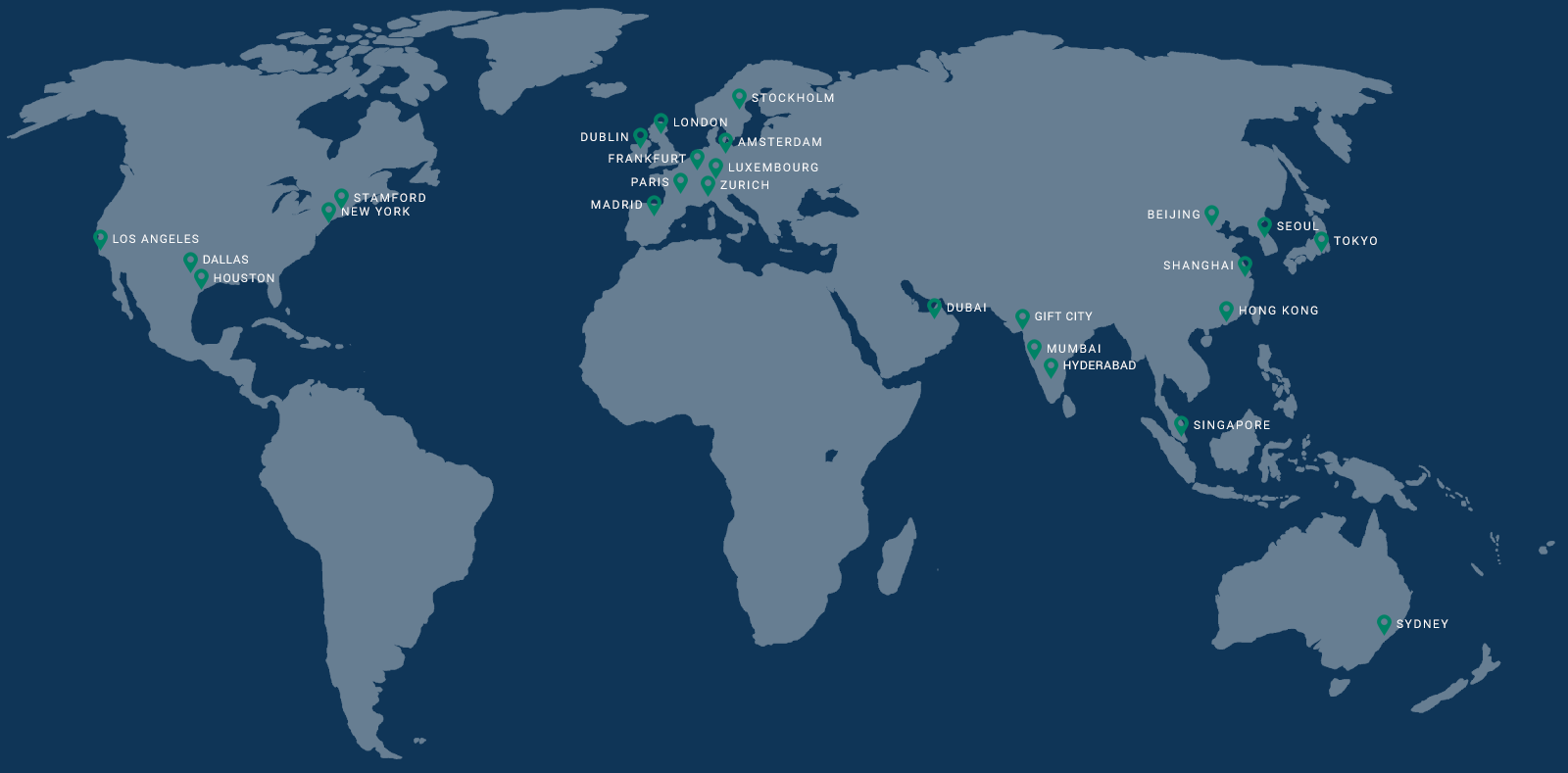

Oaktree is a leader among global investment managers specializing in alternative investments, with $223 billion in assets under management as of December 31, 2025. The firm emphasizes an opportunistic, value-oriented, and risk-controlled approach to investments in credit, equity, and real estate. The firm has 398 investment professionals, more than 1,400 employees and offices in 26 cities worldwide. For additional information, please visit Oaktree’s website at http://www.oaktreecapital.com/.

We believe that the breadth of the Oaktree platform and the collective expertise of our management team will allow us to identify numerous initial acquisition targets across the industrial, consumer and other sectors. Our multi-decade track record of successful investing in both public and private markets gives us differentiated access and insights into a deep network of institutional investors worldwide, as well as a diversified portfolio of lending relationships. Our client base includes leading pension plans, insurance companies, endowments, foundations and sovereign wealth funds. Furthermore, Oaktree expects to leverage strong relationships with banks and other financial institutions as well as brokers and attorneys. This network of contacts is instrumental in obtaining access to investment opportunities, some of which are made available to Oaktree on a highly selective, and in some cases, an exclusive, basis.